We’re already seeing that 2026 will come with its share of surprises and challenges. So many run specialty retailers, and businesses in general, are trying to navigate tariffs, tax increases, neighborhood changes, inflation, reduced traffic and a myriad of other obstacles that seem to diminish cash flow. Now, more than ever, finding the best tools and techniques to maximize cash flow has to be a big priority.

What I am about to show you is, well, kinda magical. When I first learned about these little tweaks, I was honestly and truly blown away. I think you will be too. What blew me away about this was that these are small adjustments that have enormous impact on the business. They are easy to implement, and if done properly, will bring about tremendous change.

More importantly, these tweaks or the way to ensure your retail business has good cash flow in this, or any economy. They work when things are good, and they can save you when things are not good. They can also be constantly improved upon; you don’t just do this once, you can revisit it from time to time and make it better and better.

TWEAK #1 – Adjusting your selling cost.

Most retail businesses operate on some form of base plus commission. This is an area that I find to be implemented poorly in many businesses. Many stores pay commissions on the first dollar sold (they should not be, the salespeople should need to hit a goal) and are not planned in such a way as to keep the cost of sales in line. Let’s tweak that and see the results.

First, a definition. “Selling cost” is defined as the percentage of your sales that go to pay for your salespeople. The formula for this is Total Cost of Sales (which includes salaries plus commission) divided by Total Sales (without tax).

As an example, if you have an employee whose payroll cost for last month is $1700 and that employee sells $12,500, then the selling cost for that employee is $1700/$12,500 = 13.6%.

Now, what if you put in a commission plan that keeps the sales at a good percentage, such as 9%? How? Try this – Take the hourly wage for your employee and divide it by .09. That number is the employee’s hourly goal. For example, if you have an employee that is paid $10 per hour, you would divide $10 by .09 and you would get $111.00. That is what that employee has to sell each hour.

Now take that hourly goal and multiply it by the number of hours that person works in a week. If he/she works 30 hours, the goal is $3330. As soon as they hit that goal in the week, you can pay them 9% of all sales above the $3330. This gives them incentive to sell, helps them earn great commissions and keeps your selling cost low.

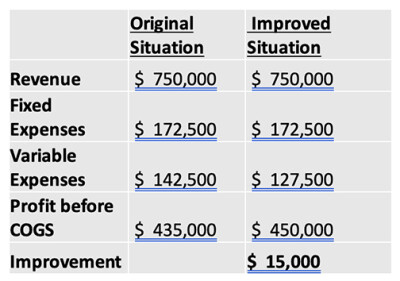

We did that in a store whose annual sales were $750,000. Look at the results below.

You can see that by implementing this strategy, we lowered their selling cost by 2%, which resulted in an extra $15,000 in cash to the bottom line. But wait, we’re not done. That’s only the first tweak!

TWEAK #2 – Lowering your purchases.

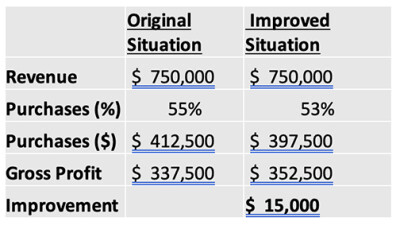

This one almost seems too easy, but watch the math. We took a store and found ways to lower their inventory purchases by 2%. Look at the results.

Yes, it’s another $15,000 improvement. But let’s be careful here. This was NOT done by hacking 2% off of all orders unilaterally. It was done by determining which classes are “signature” classes for the store and which ones are carrying more inventory than they should.

This was done systematically, using all the tools that open to buy planning (definition: open to buy is a great sales forecast by class, accompanied with an inventory plan that prevents you from overbuying or underbuying). Our overall goal was to cut purchases by 2%, but we had to figure out precisely how and where. If you aren’t using an open to buy plan to do this, you should investigate getting on to one.

TWEAK #3 – Adjusting your Markdowns.

I can almost feel you all rolling your eyes reading this one. “Oh sure, Dan, just take fewer markdown – right!” Let me start this section by saying that there is no such thing as a “perfect buyer” and my retail customers have often heard me say that buying is the toughest job in the store. Having said that, there are some strategies we can use to reduce or limit the markdowns.

First, most independent run retailers do not have a solid markdown strategy. Goods need to be given a sufficient time on the floor to sell, but after that they need to be identified as slow movers and we need to get the cash out of them. The earlier we do that (especially for seasonal goods), the lower the markdowns and the better chance of us moving through the goods faster.

Markdowns are usually caused by the following:

· Receipt of late goods

· Overbuying beyond demand

· Inadequate department/class structure

· Bad forecasting

· Bad buying

· Too broad of an assortment

· Not reacting to early poor sellers

· Bad performance on the sales floor

We can develop strategies and measurements to reduce or control all of these. Here’s a simple one – if vendors ship late, we either get free shipping, markdown money or we return the goods. Remember, shipping past a cancel date is something you do not have to permit. Cancel dates are the terms of the agreement and if the vendor violates those, you have the right to either extra compensation or to cancel the agreement.

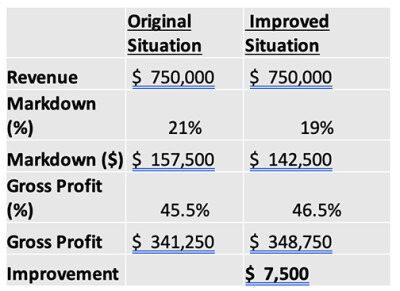

Here’s the tweak for this one — let’s lower the markdowns by 2%. Here are the results:

We produced $37,500 on a $750,000 business. Not too shabby. And it didn’t come from a crazy new marketing idea, a revolutionary new line or a magical new salesperson. It came from looking at the details of the business. It came from watching the numbers, not only based upon what happened but what we PLANNED to happen and working with the buyers, the vendors, and the store managers to bring that plan to fruition.

What if this was applied to your store? It’s worth a shot…