Two recent surveys of different types of runners have come to basically the same conclusion — runners are returning to races, but not yet in pre-pandemic numbers.

• First, a new report released by race results database Athlinks says that while it's no secret that the COVID-19 pandemic rocked the running industry, there is an “upward trend post-pandemic” trend, although “things are bouncing back more slowly than expected.”

Athlinks wondered where are the athletes that used to participate in events and what's keeping them away from racing? And what motivates those who have returned to the sport already?

So it surveyed a sampling of more than 400,000 athletes to identify post-pandemic habits and to gain a better understanding of why so many have not returned to racing.

The 2022 End Of Year State of the Industry survey showed several reasons for lackluster event participation in 2022, ranging from athlete safety concerns to being temporarily out of shape. The organization, however, reported that it seems to be reaching a turning point. Over 45 percent of respondents who have not returned to racing post-pandemic said they were either registered or plan to register for their first race within the next 12 months. Athletes also indicated that social running remained relevant and that networks of friends and family were the most likely source of finding their next race.

Among the other findings of the survey:

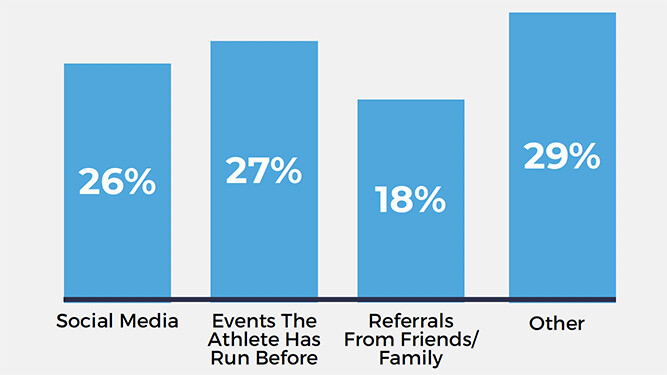

• When asked what the four main places are they go to find events, 27 percent said they were from events they have run before and 26 percent said from social media, with another 18 percent from referrals from friends and family. The large majority of "other" responses indicated that they find their events primarily via Google search or running-specific event boards. Additional notable responses included emails from the event as well as through running clubs. These results reemphasize the importance of overall digital marketing efforts for events.

• Athletes are actively searching for new events to run and it is more important than ever for events to put their best foot forward digitally. An active social media presence and SEO-optimized, user-friendly website is integral to event growth and success.

• Of those who aren't back to running yet, 45 percent are either already registered, or plan to

• 43 percent of respondents are affiliated with running groups, but only 22 percent of those who haven't returned to racing post-pandemic are part of a club.

• What are the top motivators for athletes who have resumed racing post-pandemic? Respondents indicated “fun, friendship and socialization,” “Health and Wellness,” “Competition” and “Motivation for Setting Goals.”

• Some athletes also indicated that cost is becoming an increasingly important factor in choosing in which events to participate. Saving on costs where possible in order to lower registration fees may be an impactful strategy.

• Of those who indicated that they are not currently running, approximately 16 percent cited permanent or temporary injury, 31 percent indicated that they are out of shape or out of the habit, and eight percent said that racing, or running in general, no longer appeals to them.

“This demonstrates that the majority of this population is still interested in running/racing; however, we as an industry must do more to motivate them to get back into it,” Athlinks comments.

“While the resurgence of the racing industry has progressed more slowly than many of us had hoped, there is a strong indication of a continued trend of steady growth,” the group continues. “As an industry, it is important to focus on catering to athletes who haven't returned to racing yet to help them get back into the habit. A large focus should be placed on efforts such as referral programs to reach new audiences, and now is a great time to experiment with new themes and more.

• The second recent survey comes from RunSignup, a technology solution for U.S. endurance events, whose annual RaceTrends Report shows that the industry continued to rebound from pandemic impacts in 2022, but enthusiasm for races has not yet fully returned to 2019 levels.

RunSignup’s RaceTrends report shows that race participation grew an average of 16 percent compared to 2021, but races struggled to achieve pre-COVID participation, with race participation still down an average of 10 percent from 2019. Large races appear to be the most impacted by lagging participation, with races of more than 5000 participants averaging 19 percent fewer participants than in 2019, while races with fewer than 500 participants actually grew 3.4 percent compared to 2019.

Additional key takeaways include:

- 20 percent of 2019 events did not take place in 2022, including 14 percent that did not take place in either 2021 or 2022.

- Just 14 percent of participants from 2021 repeated the same event in 2022 (down from 19 percent in 2018).

- In-person experiences dominated over virtual events, making up 88 percent of all events and 93 percent of all participants.

- Prices have increased across all distances, with the average 10K price set six percent higher than in 2019 and 10 percent higher than in 2021 (when virtual events still significantly impacted pricing).

- Females make up the majority of participants, with 54 percent of participants identifying as female

- Youth participation continues to be a concern, with 15 percent of all participants between 18-29 (down from 18 percent in 2018).

- 25 percent of all registrations came on race week, consistent with race week registrations throughout the last five years.

“The numbers from 2022 confirm what our customers have been reporting: Endurance events continue to face some headwinds,” points out CEO and Founder Bob Bickel. “However, we are seeing some successes and stabilization in the industry. Race organizers who take a proactive approach to increasing awareness for their events and provide incentives like referral programs are helping to drive the rebound in participation levels. We are definitely seeing positive trends and predict this slow rebound will continue in 2023 .”

The report was built by mining RunSignup’s registration and finisher data covering a five-year period to generate transparent statistics, identify trends in the industry and provide recommendations to boost endurance event participation. It is estimated that the data on RunSignup accounts for 35-40 percent of the U.S. endurance market. The data in RunSignup’s 2022 RaceTrends report includes more than 68,000 race events and 8.3 million registrations.