Run specialty has reopened for business, customers are returning, e-commerce is here to stay and a “slow but steady climb back to normalcy” is expected.

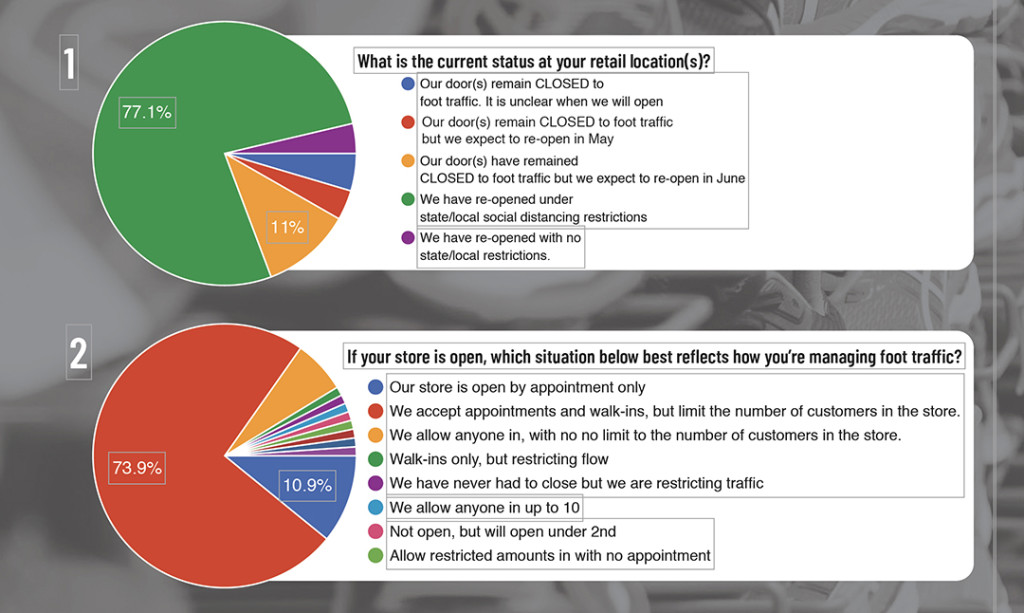

Those are the key takeaways from a recently released COVID–19 Retailer Survey (Phase 2) of 115 run specialty retailers by the Running Industry Association (RIA). The good news is that 81 percent of run specialty doors are accepting foot traffic and an additional 10 percent expect to do so in early June. More good news: 31 percent matched or exceeded May month-to-date numbers compared to last year and June projections are even stronger.

The not-so-good news (for vendors in particular): “Conservative” is the word for inventory planning. In the third and fourth quarters of 2020 retailers are planning on reducing inventory and/or will narrow assortments to key styles. That trend will continue into Spring 2021 to a slightly lesser degree.

But overall the results of the Phase 2 survey are much more optimistic than those reported in Phase 1 earlier this spring as the full impact of the COVID-19 pandemic was first being felt. Among its other findings:

- It will likely be a slow but steady climb back to normalcy — 74 percent project sales to return to normal by the first quarter of 2021, while the remaining 25 percent believe it will take 12 months or more to return to pre-COVID sales projections.

- E-commerce is here to stay – 81 percent are using some type of e-comm platform and 59 percent intend to continue to use e-comm platforms post-crisis. Further, respondents see their new omnichannel strategy providing an incremental growth opportunity.

- Retailers are now more confident that they will weather the storm — 93 percent report confidence that they will be able to avoid closing their doors permanently. This is a dramatic improvement from only 27 percent who felt confident about remaining viable in the March survey.

- Second half sales projections are also trending upwards, but only towards previous levels — 43 percent project sales down 1-20 percent, while 28 percent project up or flat.

- As for layoffs in the face of the pandemic, 53 percent of run retailers report they have had to lay off or furlough some staff, while 36 percent have not laid off or furloughed staff. Only 11 percent laid off or furloughed their entire staff.

- Almost all retailers that responded – 96 percent – applied for the federal Payroll Protection Program (PPP), with 95 percent receiving PPP payments. And 39 percent applied for the Economic Injury Disaster Load Emergency Advance (EIDL), with 34 percent receiving EIDL loans.

- Finally, in perhaps the best news of all, in response to a question about whether the store feels confident it will remain viable post-COVID-19, an overwhelming 93 percent responded “YES.”

One retailer comment (all responses were anonymous) perhaps sums up the general mood within run specialty in June 2020: “I think run specialty is more insulated from downturns than other industries. We are reducing risk by tightening inventory but have been up around 50 percent since opening three weeks ago. I’m prepared for that to drop down to 2019 levels for Q3/Q4 but all not convinced it will happen.”

To view the full survey: https://drive.google.com/file/d/17b2OqTZe6ZH_JQLUJP026iW3FnLIWavi/view