1. Brooks’ Indiana distribution center. After years as run specialty’s darling, Brooks endured a tough 2019 with significant issues plaguing its new North American distribution center in Whitestown, IN. At The Running Event 2019 in Autin, TX, Brooks CEO Jim Weber (photo right) said the company learned “a lot of expensive, painful lessons” and acknowledged “a crisis” that Brooks did not manage or execute well. Weber promised that Brooks would remain in “fixing mode” to correct the problems and restore good will. “We have to execute promises to our retailers,” he told the TRE crowd.

2. Mary Cain. The former running prodigy dropped a bomb on the sport last November when she levied charges of emotional and physical abuse against Nike’s now-defunct Oregon Project and coach Alberto Salazar in a New York Times video op-ed. Where does Cain, once seemingly destined for Olympic glory, go from here? What’s her next chapter?

3. Nike’s relationship with run specialty. On December 13 the New York Times published its own analysis of Nike’s carbon fiber-plated shoes and “found that a runner wearing the most popular versions of these shoes available to the public – the Zoom Vaporfly 4% or ZoomX Vaporfly Next% – ran four to five percent faster than a runner wearing an average shoe.” It’s the type of finding running shops and their hard-core customers gush over, but run stores, by and large, aren’t having much luck with Nike these days. On Jan. 13, Mark Parker, a Nike employee since 1979, departed as CEO, handing the reins to John Donahue, the former CEO of eBay. To many, Donahue’s arrival suggests Nike’s appetite for brick-and-mortar run specialty will only further decline.

4. Koichiro Kodama. Kodama enters 2020, his first full year as head of the ASICS America Group segment, at a pivotal time for the company. About a decade ago, ASICS enjoyed roughly 40 percent market share in run specialty footwear sales. That figure fell sharply as the company expanded into new distribution channels and faced intense competition from both established footwear brands and innovative up and comers. Many industry personnel suggest the bleeding has stopped. Now, what will Kodama do to further stabilize the business and push ASICS forward?

5. JackRabbit. In October, JackRabbit, the national chain of running stores powered by private-equity firm CriticalPoint Capital, acquired Maine-based retailer Olympia Sports. The deal signaled JackRabbit’s confidence in its business as well as its ambitions to grow. Recently they announced the closing of 76 of the Olympia stores, leaving it to operate the remaining 75. CEO Bill Kirkendall has publicly stated that the company will continue to explore active lifestyle specialty companies and additional acquisitions. In 2020, the smart money sits on JackRabbit being active.

6. Hoka One One and On Running. After five years of sluggish sales numbers in the run specialty channel, sales climbed in 2019. Some industry insiders attributed that turn to two ascendant brands with a heavy presence in run specialty: Hoka and On. As buzz and followings mount for both brands, will either – or both – more aggressively expand distribution beyond run specialty, including into major mainstream channels? If so, that would be a firm uppercut to specialty run.

7. The fashion tastemakers. A decade ago, the performance running category sizzled in fashion, fueled by bold footwear colors and designs. In recent years, however, the performance running category has struggled mightily to trend in fashion. Might the fashion tastemakers and Instagram influencers return to embracing performance running goods? Fashion moves fast these days. Will it reunite with performance run?

8. The Trump administration and tariffs. The Wall Street Journal printed the word tariff more than 9000 times. That was 2000 times more than the previous 10 years combined, demonstrating just how prevalent talk of tariffs has become. Though 2020 began with news of improved U.S.-China relations on the trade front and optimism that the sporting goods space would be spared further damage, savvy observers remind that the political winds shift fast these days — and might even accelerate in an election year.

9. Boomer owners. Compared to other retail sectors, run specialty is a young field with many stores across the U.S. yet to celebrate a 10th anniversary let alone a 20th. Still, run specialty has its share of patriarchs entering a third or even fourth decade with still-involved owners at or near retirement age. It’s something run specialty hasn’t yet confronted en masse, but a notable issue as a new decade opens — and the channel’s outlook brightens. Do these seasoned owners have an exit strategy or transition plan in place? Will they listen to offers? Do they plan on liquidating inventory and simply closing shop? In the coming years, voids might open in certain markets and established stores could be changing hands.

10. Female empowerment. Elite athletes such as Allyson Felix, Kara Goucher (photo below), Alysia Montaño and the aforementioned Mary Cain have put the support of elite female athletes front and center. The 2020 Olympics, meanwhile, will provide some of the world’s best female athletes a megaphone to champion their issues and compel action, particularly from their brand sponsors.

11. Rugged Races. Last August, Rugged Races purchased RAM Racing, the Chicago-based outfit behind the nationwide Hot Chocolate series (photo above). The RAM deal was the latest in a series of moves by Rugged Races, following acquisitions of the Milwaukee Marathon, the Providence Marathon, the Fargo Marathon and the Santa Rosa Marathon en route to becoming one of the nation’s largest endurance-event companies. Rugged Races, which initially captured attention after earning a $1.75 million investment from Mark Cuban on “Shark Tank,” now owns nearly 100 events across North America and doesn’t plan on hitting the brakes anytime soon.

12. Carbon fiber. After years of “foam” stories in performance running footwear, carbon fiber has helped some footwear brands shift the narrative. From Nike to Hoka to New Balance, several companies have jumped into the carbon craze and brought products to market, while many others are teasing their own carbon-fueled developments.

13. Todd Dalhausser. A respected industry presence who had served as senior VP–sales for Saucony, Dalhausser joined Altra in late 2018 as the brand gained its footing under new ownership in VF Corp. As Altra’s new president, Dalhausser wasted little time getting to work. He executed initiatives to better position Altra with female consumers, improve footwear aesthetics and deepen the brand’s presence in run specialty doors. Oh, and he also initiated a movement away from Altra’s “Zero Drop” vernacular in favor of “Balanced Cushioning.” With a stated commitment to run specialty, a stronger, more strategic Altra could represent a positive development for the channel.

14. Poop. Yes, that’s right, poop. Researchers around the globe, including scientists at Harvard University, are beginning to explore potential links between athletic performance – endurance, strength, recovery and the like – and the gut microbiome. A December 2019 ESPN story highlighted the growing, though still-nascent field and there’s blossoming interest in the research, including the potential development of performance-enhancing probiotics. Expect to hear more about poop in 2020.

15. CBD. The CBD category is growing at a rapid clip in both mainstream channels as well as run specialty, where upstart companies are peddling CBD creams, energy shots, oils, drink mixes and more. Yet, many consumers remain hesitant, skeptical and confused about CBD products. For those run specialty stores embracing the category, a little consumer education could go a long way.

16. “Digitalized” running. Various industry players are trying hard to blend the real world and the digital world, connecting one’s physical run to a digital ecosystem. One intriguing option: U.K-based startup NURVV. The company’s wearable tech provides feedback on a runner’s gait to help improve performance and reduce injury risk.

17. Dan Sullivan. An industry vet who claimed previous stops at New Balance and Saucony, where he rose to the rank of VP–sales, Sullivan joined Skechers at the end of 2018 as its national sales manager of performance. While Skechers is a global footwear behemoth, it has largely struggled to make inroads in run specialty. Sullivan desires to change that by maintaining clean distribution, building Skechers’ on-the-ground sales force and, above all, pushing product innovation, an effort led by Hyper Burst, the company’s new midsole foam that has generated positive buzz and reviews.

18. Galen Rupp. At the 2016 Olympic Games in Rio, Rupp earned a bronze medal in the marathon. In the years since, he’s scored a Chicago Marathon victory, notched a 2:06 marathon PR and continued competing at an elite level. In 2019, however, he battled a significant Achilles injury and, more to the point, saw Alberto Salazar, his long-time coach, receive a four-year ban for violations. Controversy will likely continue to swirl around Rupp, who has laid low since dropping out of the Chicago Marathon last October.

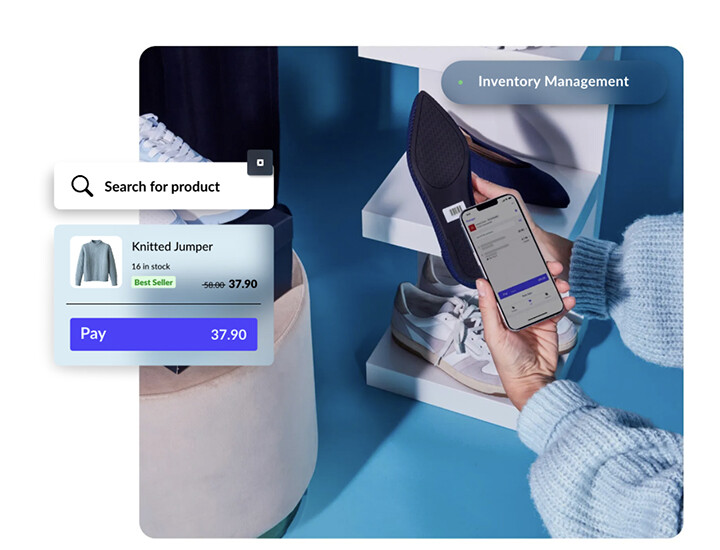

19. Fitted. Competition from the Internet players such as Amazon and Zappos as well as brands’ direct-to-consumer efforts continue to draw the attention – and the ire – of run specialty owners. With an estimated 30 percent of athletic footwear purchased online, according to NPD data, running retailers continue seeking ways to up their digital presence. Fitted, an omni-channel solution headed by running retailer Monte Keleher of California-based A Runner’s Mind, represents a potential channel-friendly answer.

20. Tokyo. The world’s eyes will turn to Tokyo in late July when Japan’s capital city hosts the Games of the XXXII Olympiad. Sports, fashion and culture will all collide and the 2020 Olympics are sure to produce some of the year’s most memorable moments and, just perhaps, ignite interest in running and push traffic into run specialty stores.