Source: PwC 2017 Total Retail Survey

For Kathy Gates, the e-mail’s subject line said it all: “Friends don’t let friends buy running shoes online.”

Battling the increasing thrust of online shopping, Gates, owner of The Running Well Store, went on the offensive with an email to customers highlighting the differences between shopping online and visiting one of her two stores in metro Kansas City.

Gates noted the hassle of online shopping, citing research from the University of Regensburg that found 30 percent of shoppers returned items purchased online, before underscoring the expertise of her staff and the ability of the stores’ training groups to boost athletic performance.

“At The Running Well Store, we believe in the perfect fit through a stride analysis, having top-notch customer service, excellent product knowledge and developing a supportive community helping our customers achieve their goals,” Gates’ e-mail said.

To hammer the point home, Gates also invited customers to share their best online shopping horror stories on the company’s Facebook page. The social media post reached more than 2,800 people and generated 22 comments as people relayed tales of weeks-long shipping delays and exorbitant fees, products not matching their online descriptions, shoddy packaging and ordered items wiggling into others’ hands.

“Everybody has an online horror story and can relate to the pain of shopping online,” Gates says. “We wanted to highlight that we will send you out with the right product and back it up with a 30-day, no questions asked return policy.”

With e-commerce currently accelerating at an 8-12 percent annual clip according to the National Retail Federation and 2017 sales estimated to approach $450 billion, online shopping has emerged as a grave concern among the nation’s brick-and-mortar retailers, including run specialty shops facing stiff competition from the likes of Amazon and Zappos as well as manufacturers’ own websites.

“Ten or 20 years ago, you could just hang out your ‘Open’ shingle and people would beat a path to your door, but that Golden Age of run specialty has passed and retailers have to get better at what they do because online is here to stay,” Running Industry Association executive director Terry Schalow says.

Taking online shopping to task

Messaging, like The Running Well Store’s e-mail, is one way running shops have worked to extract customers from the tug of e-commerce. From spotlighting the value of genuine human interaction inside a brickand- mortar store to identifying the economic benefits of shopping local, many run shops are putting a full-court press on online shopping by trying to appeal to customers’ hearts and minds.

But messaging is far from the only strategy run shops are employing to compete with e-commerce.

This summer, Pacesetter Sports in Terre Haute, IN, began price matching, boldly sharing news of its new store policy on the shop’s highway marquee. Owner Brent Compton grew tired of seeing customers whip out their phones to investigate prices, some eventually leaving his store to have an item shipped to their home two days later for a $5 savings.

“Competitive pricing is the single biggest factor that will get those customers to put their phones away,” Compton says. “This assures our customers that we do not want to be beat on price.”

Though admittedly “scared to death” to initiate a price-matching policy, particularly in the age of liquidation and flash sales, Compton says he has only felt burned a “few times” since unveiling the store policy.

“Most often, customers are pumped that we offer this and that’s making them more loyal to us,” he says, adding that the price-matching risk further dwindles if – and, admittedly, a big if – brands enforce minimum advertised pricing (MAP) on current models.

“Competitive pricing is such a big deal and I feel we need to embrace it,” he continues. “We’re going to get through it by communicating with our customers and staying transparent rather than fretting about it and looking backwards.”

Stores like the Lincoln Running Company in Nebraska’s capital city, meanwhile, have turned to offering free shipping as well as same-day delivery of products to local customers.

“This has helped a ton,” manager Ann Ringlein says of same-day delivery. “People are amazed by it and it makes them feel that we care and want to earn their business.”

Similarly, Fleet Feet Chicago debuted its “shoe valet” service, a fleet of vehicles, bikes and employees running product out to local customers within a certain radius, about four years ago. Fleet Feet Chicago senior vice president of sales and marketing John Moloznik describes the shoe valet service as “a first step to tackling the convenience so many of today’s customers want.”

As another convenience play to counter e-commerce, the Lincoln Running Company is readying plans to hop on Locally.com, the online channel that provides information on where specific goods are available in a given community.

“We believe this will send people to us,” Ringlein says of Locally. “I do think this younger generation wants to buy local, but it has to be convenient for them.”

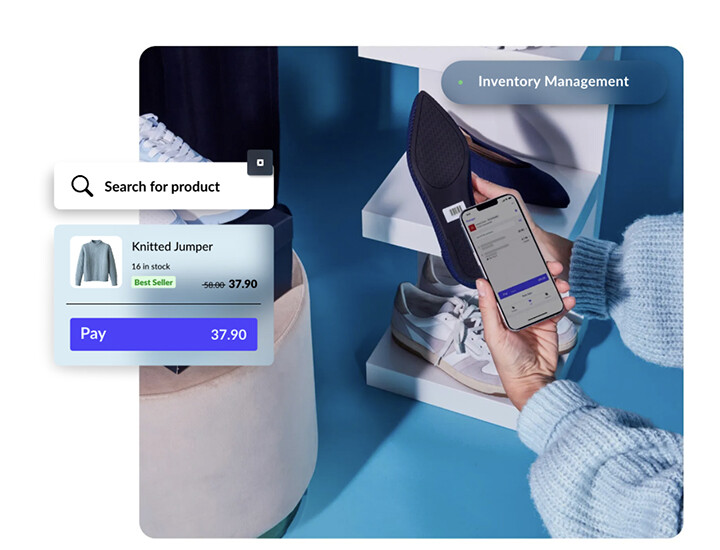

Inventory stands as another piece in the battle against e-commerce. Compton says he has partnered with vendors to make sure Pacesetter Sports has key sizes and styles in stock so people can “touch it and feel it,” while Ringlein has had conversations with staff about bringing out footwear that’s not as easy to purchase online, such as Altra and Hoka One One.

“We have some built-in defense [in the run specialty channel] because many people want to try on shoes first before dishing out $100,” she says. “Still, we have to bring out footwear they have to think about.”

Cracking the code

When it comes to pricing and shipping, Ann Arbor Running Company owner Nicholas Stanko isn’t convinced brick-and-mortar run shops should be trying to directly compete with e-commerce. Instead, he contends that running stores should be focusing on things online outlets can never do, such as making real, authentic connections in the communities and putting people before product.

“We should be focusing on connections and relationships with people at all levels of our businesses,” Stanko says.

The RIA’s Schalow echoes that sentiment, urging shops to double down on community and helping customers feel like a part of the club with training programs and by creating social context for customers. Such connections, he contends, are crucial to battling e-commerce.

“It goes far beyond a well-merchandised store with great product selection and service,” Schalow says. “It’s about servicing customers after the sale to make the next sale.”

Though Compton unveiled price matching at Pacesetter Sports, he, too, sees a “best friend” relationship with customers – a longstanding differentiator for the run specialty channel – as vitally important to competing with e-commerce now and in the years ahead.

“We have to provide an intimate experience filled with positive energy and genuine communication each and every time, which is not something customers are going to get on a device,” he says. “The service, the relationship, the affection, that’s how we win this battle in the long run.”

That said, Compton’s still hedging his bets because “even in the most intimate and seemingly loyal of relationships, customers can still have their phones out.” Great in-store service alone, he says, can’t be the sole play.

To that point, Compton plans to increase Pacesetter’s online presence in 2018. If not directly selling online, he will at least have information available on pricing, recommendations and availability as customers are researching their purchases. According to PwC’s 2017 Total Retail Survey, 52 percent of global shoppers prefer to research their clothing and footwear purchases online.

“Upping our web presence keeps us in the process instead of getting left out of that equation,” Compton says.

Ultimately, Ringlein says, independent run shops must stay actively engaged in their business, which means consistently looking to strengthen their customer service while also taking some calculated risks to bolster convenience, accessibility and their competitive standing in the marketplace.

“We have to keep doing what we do and doing it better,” she says. “I don’t know if we can crack the code, but I know we need to continue to work at it.”